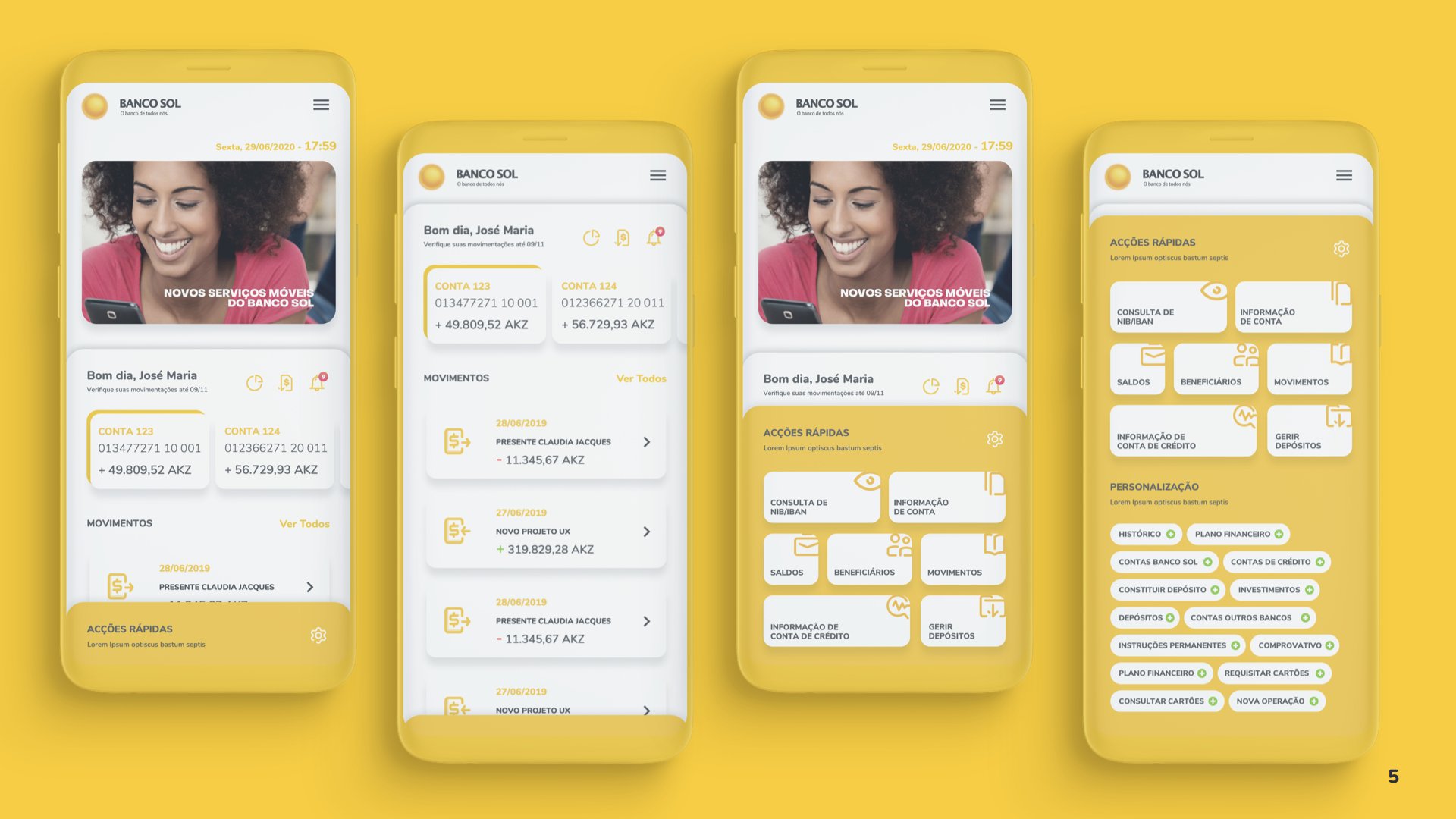

Banco Sol

Lead Product Designer - Android and iOS App - May 2018

The Case

The Banco SOL Mobile App was designed to revolutionize how users interact with financial services in Angola, streamlining everyday banking operations while delivering a seamless digital experience. As Lead Product Designer at Innovation Makers, I oversaw the app's entire design lifecycle—from conceptualization to launch—focusing on usability, accessibility, and aligning with both user needs and business goals.

Key Objectives

Enhancing Accessibility: Create a mobile banking solution that is easy to navigate for a diverse user base with varying levels of digital literacy.

Streamlining Key Banking Functions: Simplify essential services like account management, bill payments, transfers, and loan applications, ensuring quick access and reduced friction.

Building Trust Through Transparency: Prioritize secure user interactions and data visualization that clearly communicates account activity and balances.

Localized Experience: Incorporate design elements tailored to the Angolan market, including bilingual (Portuguese and English) language options, cultural design sensibilities, and locally relevant services.

Process

Discovery

Conducted user interviews with existing Banco SOL customers to understand pain points with existing banking platforms.

Collaborated with stakeholders, including bank executives and development teams, to align on core business goals.

Performed competitive analysis of other regional and global banking apps to identify areas of differentiation.

Wireframing & Prototyping

Created low-fidelity wireframes to outline user flows, focusing on high-frequency tasks such as checking balances, making transfers, and paying bills.

Iterated on interactive high-fidelity prototypes using Figma, enabling stakeholders and user groups to test the app before development began.

User-Centric Design

Implemented service blueprinting to visualize the entire end-to-end experience, identifying back-end dependencies to ensure the seamless execution of user actions.

Focused on visual hierarchy and accessibility, using a clean UI with intuitive navigation, large touch targets, and readable fonts for mobile screens.

Integrated culturally relevant iconography, color schemes, and terminology to foster familiarity and trust among Angolan users.

Agile Collaboration

Worked closely with cross-functional teams of developers, engineers, and product managers to ensure the design was translated accurately into the final product.

Participated in sprint reviews and provided iterative feedback to address usability challenges during the development cycle.

Designed workflows for localized services such as mobile top-ups and government payment portals.

Key Features

Account Overview

A centralized dashboard displaying balances, transaction history, and account insights in an easy-to-read format.

Payments & Transfers

Streamlined workflows for bill payments, peer-to-peer transfers, and QR-code payments.

Loan Application

Enabled customers to apply for and track loans directly within the app, simplifying traditional banking procedures.

Multi-Currency Support

Allowed users to manage accounts in multiple currencies, reflecting Banco SOL’s international reach.

Secure Authentication

Introduced biometric login (fingerprint/face recognition) and two-factor authentication to bolster security.

Impact

Increased User Adoption: The app saw a significant surge in downloads post-launch, reflecting the demand for a modern banking experience.

Reduced Friction in Transactions: Customers reported quicker transaction times and improved satisfaction compared to previous banking channels.

Enhanced Accessibility: The intuitive design allowed even first-time digital banking users to adopt the app with ease.

Operational Efficiency: The self-service options available through the app reduced dependency on physical branches, improving Banco SOL’s operational efficiency.

Lessons Learned

Achievement:

The Banco SOL Mobile App remains a standout project in my career, embodying the principles of user-centered design and highlighting the transformative potential of fintech in emerging markets. It reinforced my ability to deliver meaningful digital experiences while aligning with cultural and business needs.

Main Aspects:

Design for Digital Literacy: A significant portion of users in emerging markets are new to mobile banking, so simplicity and clarity are critical in both UI and UX design.

Iterative Feedback is Key: Involving both stakeholders and end-users during early prototyping phases reduced rework and led to more relevant solutions.

Localized Design Matters: Customizing the experience for the Angolan market—from language to visual motifs—was instrumental in building user trust and engagement.

Design Process:

Wireframes: Mapped out user flows, emphasizing simplicity and accessibility.

Prototypes: Developed high-fidelity prototypes for testing interactions and usability.

User Testing: Conducted iterative testing with diverse user groups, refining the design based on feedback.

Visual Elements:

Color Palette: Mirrored the branding with shades of violet and lilac for trust and growth.

Typography: Used a modern, legible typeface for clarity.

Motion Design: Added subtle animations to enhance user interactions without overwhelming the experience.

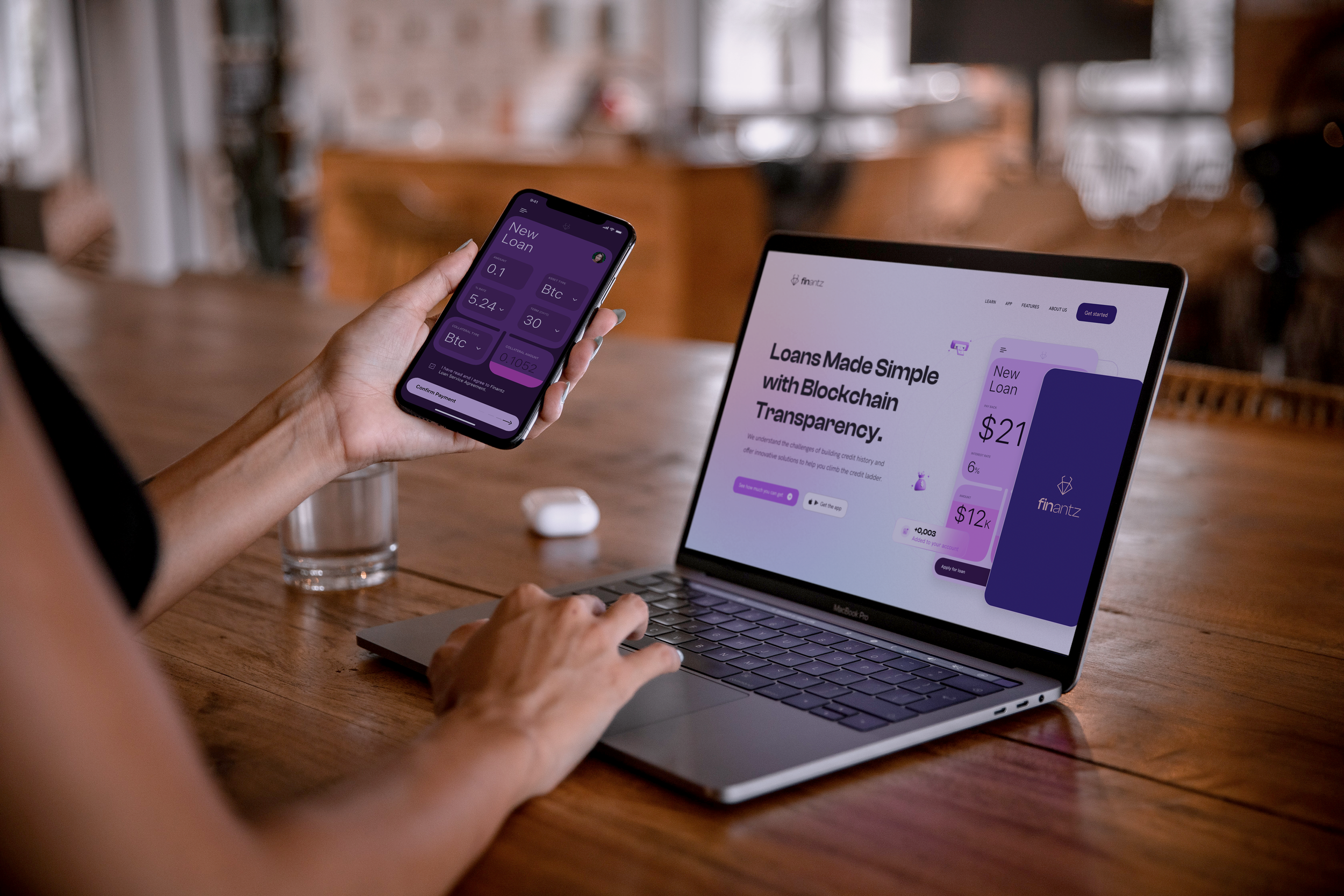

App Design

Objective:

Create an intuitive and secure app experience for managing loans.

Key Features:

Seamless Loan Management:

Users can apply for loans, track approval statuses, and manage repayments effortlessly.

The dashboard provides a consolidated view of outstanding loans, repayment schedules, and financial insights.

Blockchain-Powered Transparency:

Users can access a detailed transaction history secured on the blockchain.

Smart contracts ensure clarity and reliability for all loan agreements.

Financial Insights:

Integrated financial analytics to help users make informed decisions.

Visualized loan repayment progress with data visualization tools.

User-Centric Design:

Clean and intuitive interface designed with Figma.

Consistent visual hierarchy and accessible navigation tailored to both experienced and new users.

Outcomes

The Finantz Loans Platform stands as a pioneering example of how blockchain technology is actively reshaping fintech solutions. As a Product Designer and UX Strategist, I am leading the ongoing efforts to create a platform that empowers users to manage loans with trust, transparency, and ease. Applying a user-first design approach, I am crafting intuitive workflows and interfaces that simplify complex financial tasks, ensuring accessibility and usability for a diverse audience.

The platform is currently in technical development, and strategic branding and marketing efforts are underway. These efforts aim to position Finantz as a modern and innovative solution in the competitive fintech landscape.

Lessons learned

The Finantz Loans Platform is an ongoing initiative to redefine loan management through blockchain technology, blending trust, transparency, and user-centric design. As a Product Designer and UX Strategist, I have focused on creating a seamless experience for users navigating the complexities of loan applications, approvals, and repayments. Leveraging blockchain's inherent transparency and security, the platform ensures users can confidently manage their loans and financial agreements with ease.

This project has offered valuable lessons in the crypto industry’s product design landscape, particularly in addressing user trust and simplifying technically dense concepts. Designing for crypto-fintech products requires balancing innovation with clarity. Users often find blockchain intimidating; therefore, crafting a simple, intuitive interface was paramount. Financial visualizations, transaction histories, and repayment tracking were built with accessibility and transparency, ensuring users can easily comprehend and trust the platform.

Additionally, the design effort emphasized the importance of user education and seamless onboarding in the crypto space. Clear micro-interactions, contextual help, and actionable feedback loops were integral in fostering user confidence, essential when dealing with emerging technologies like blockchain.

This experience deepened my understanding of the need for adaptive design frameworks to accommodate regulatory changes, user diversity, and evolving blockchain innovations. The Finantz platform’s ongoing technical development and marketing initiatives reflect this adaptability, ensuring the final product meets user expectations and set a new standard for crypto-enabled fintech solutions.