Finantz

An innovative crypto-enabled loan platform that leverages blockchain technology to streamline the loan application, approval, and management process.

The Case

The Finantz Loans Platform was designed as an innovative solution for modern financial needs, leveraging blockchain technology to simplify loan management and foster trust and transparency.

Context

This case study explores how I tackled the multifaceted challenges of branding, marketing strategy (WIP), and Product Strategy & Design — product landing page and app design (iOS and Android), to establish Finantz as a leading crypto-enabled loan platform. Finantz aims to leverage blockchain technology to streamline the often complex and opaque loan applications and management world. My role involved creating a cohesive brand identity that communicated trust and transparency, devising marketing strategies that resonated with tech-savvy crypto enthusiasts and traditional borrowers, and designing a user-friendly product interface that made financial management intuitive and accessible.

Integrations

By integrating secure blockchain protocols, simplifying user workflows, and employing data-driven insights, I sought to transform Finantz into a platform that empowers users with actionable financial tools and establishes itself as a trusted leader in the rapidly evolving fintech and blockchain landscape. This case study highlights the strategies and design decisions contributing to Finantz's successful positioning and adoption in a competitive market.

Branding

Objective:

Create a trustworthy and modern brand identity that resonates with users in the financial and blockchain sectors.

Logo

The logo effectively blends elements of modernity with a sense of structure, which aligns well with blockchain and fintech principles. Incorporating diamond shapes and geometric structures with the “Ant” profile adds value, safety, and reliability, resonating with the financial sector.

Typography

The selection of "Clash Display Medium" and "Clash Display Light" reflects a modern, approachable aesthetic. These clean, sans-serif fonts align with fintech trends and ensure platform legibility.

Color Palette

The primary use of violet (#27145D) conveys trust, sophistication, and reliability, while the secondary (#F6C3AE) and tertiary (#AA56D9) colors provide warmth, protection and creativity. This palette is visually appealing and fosters a sense of user connection.

Tone of Voice

The established professional yet approachable tone is ideal for targeting both tech-savvy crypto users and traditional financial clients. This balance ensures accessibility for a broader audience.

Marketing Strategy

Objective:

Position Finantz as the go-to crypto-enabled loan platform by targeting crypto enthusiasts and financially underserved users.

Approach:

User Personas:

Crypto Enthusiasts: Highlighted the blockchain-powered transparency and security.

Traditional Borrowers: Emphasized ease of use and streamlined processes for non-tech-savvy users.

Channels:

Content Marketing: Developed blog posts and explainer videos on how blockchain simplifies loan management.

Social Media: Focused on Instagram and LinkedIn to target both millennial crypto enthusiasts and fintech professionals.

Paid Campaigns: Ran ads on Google and Facebook with attention-grabbing headlines like “Loans Made Simple with Blockchain Transparency.”

Influencer Partnerships: Collaborated with crypto influencers to build trust and expand reach.

Key Campaigns

The goal of this campaign is to establish Finantz Loans Platform as the go-to crypto-enabled loan solution in the market by building trust, creating awareness, and driving user acquisition. The campaign focuses on communicating the platform’s innovative features—blockchain-powered transparency, simplified loan management, and financial empowerment.

By combining the Traditional Media, OTT Platforms, and Social Media approaches, the campaign ensures that the Finantz Loans Platform reaches the right audiences, builds trust, and converts interest into action, all while positioning itself as a modern, innovative, and user-first financial solution.

Traditional Media: Building Credibility and Broad Awareness

Press Releases: Distribute press releases to key financial, tech, and blockchain industry publications to announce Finantz's launch and highlight the innovative use of blockchain for secure loan management.

Print Ads: Create visually compelling print ads for finance magazines, targeting investors and professionals interested in fintech innovation.

Out-of-home advertising (OOH): Roll out billboards and transit ads in key financial hubs (e.g., New York, San Francisco) with simple, eye-catching visuals and taglines like “Loans Made Transparent. Powered by Blockchain.”

Radio Campaigns: Collaborate with financial radio shows and podcasts to explain Finantz's benefits, creating trust through expert endorsements.

OTT Platforms: Educating the Market Through Engaging Content

Video Ads: Develop short, engaging video ads showcasing how Finantz simplifies the loan process. Use storytelling to show a relatable user navigating financial complexities, finding a solution through Finantz, and enjoying peace of mind.

Partnerships with Fintech Content Creators: Partner with creators on OTT platforms like YouTube and streaming platforms with fintech or crypto audiences. Sponsor educational video content explaining blockchain’s role in secure loan processes.

How-To Mini-Series: Produce a branded mini-series on OTT platforms like Hulu or YouTube, educating users on crypto-enabled loans and positioning Finantz as the easiest platform to get started.

Smart TV Ads: Run targeted video ads on platforms like Roku or Amazon Fire TV, focusing on crypto users and blockchain enthusiasts.

Social Media: Driving Engagement and Building a Community

Target Platforms: Focus on Instagram, LinkedIn, Twitter, and TikTok to engage different audience segments—professionals, tech enthusiasts, and younger crypto-savvy users.

Influencer Partnerships: Collaborate with crypto, fintech, and personal finance influencers to create authentic reviews, tutorials, and live Q&A sessions.

Educational Content:

Instagram & TikTok: Post short, engaging videos explaining blockchain-powered loan features, how Finantz ensures transparency, and why it’s the future of finance.

Twitter Threads: Post thought leadership content around crypto loans, blockchain transparency, and the platform’s value proposition.

LinkedIn Articles: Publish in-depth pieces to target professionals in fintech and blockchain industries, creating credibility and thought leadership for Finantz.

Social Ad Campaigns: Launch paid campaigns across social media platforms, leveraging AI-driven targeting to reach crypto users, young professionals, and first-time borrowers. Focus on key benefits: security, transparency, and ease of use.

Campaign Integration

Each channel reinforces the message with consistent branding and storytelling:

Traditional media builds broad awareness and credibility, reaching audiences less active in digital spaces.

OTT platforms educate and inform through compelling video storytelling.

Social media drives engagement, builds trust, and generates leads through community interaction and targeted content.

Product Strategy & Design

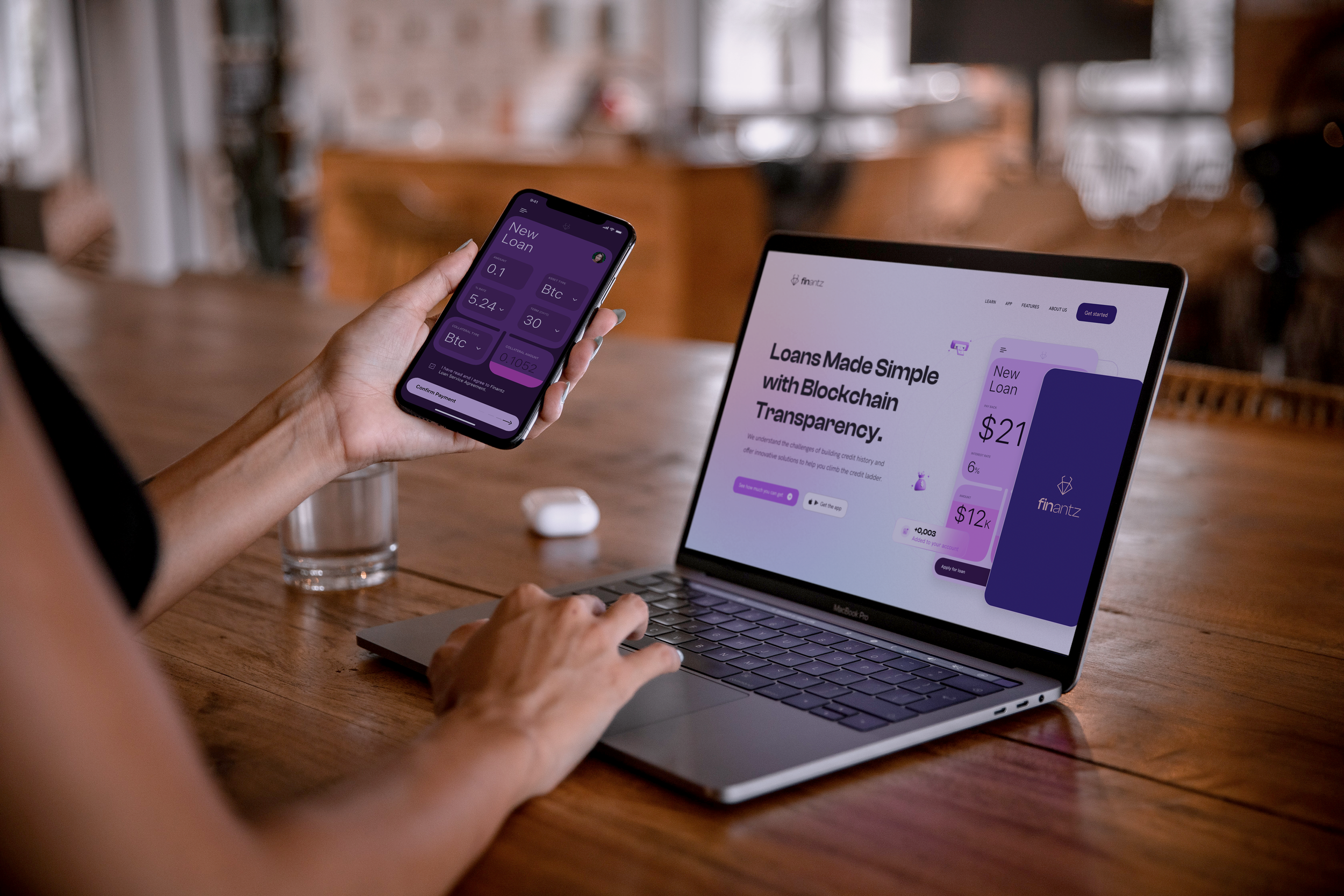

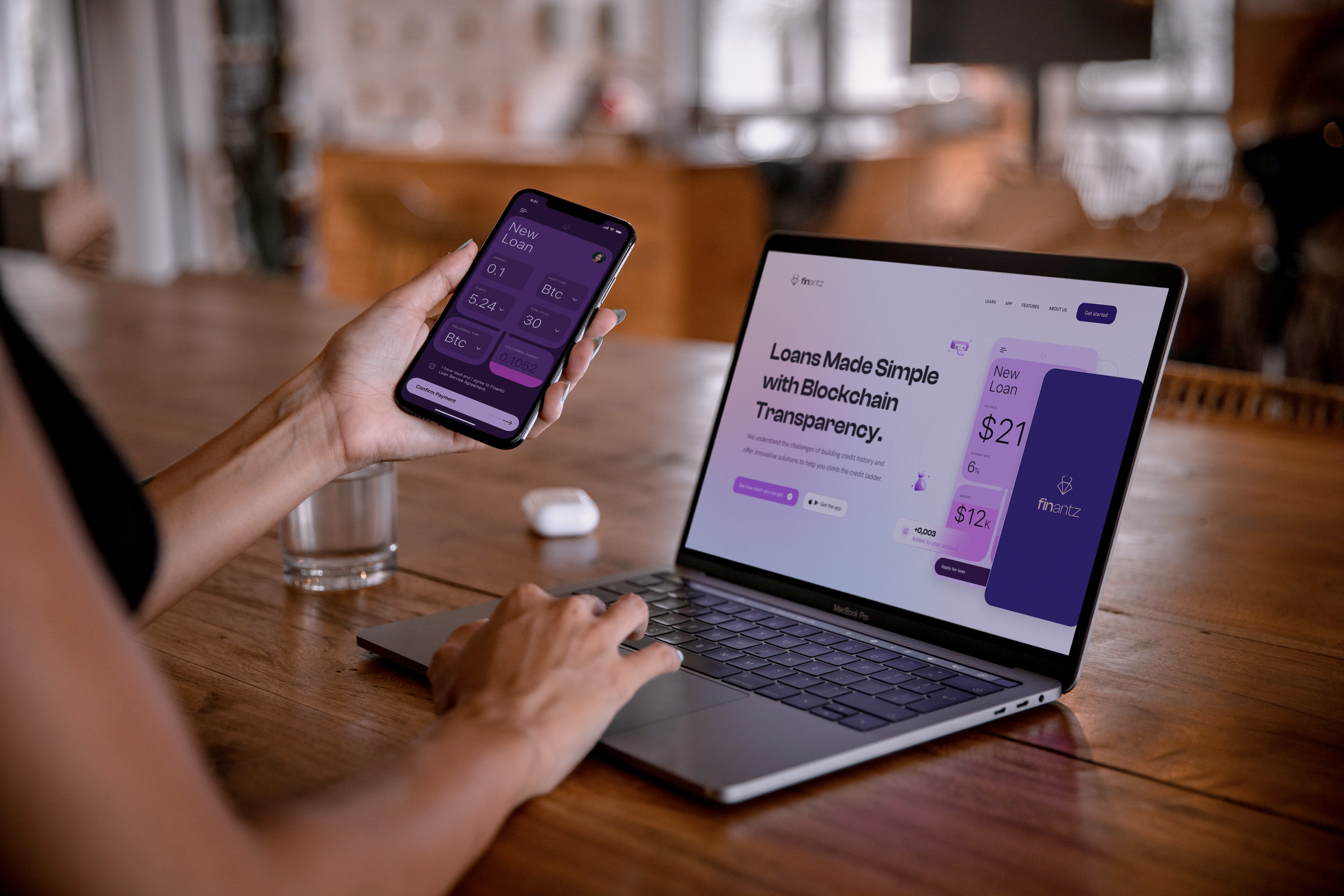

Product Landing Page

Objective:

Develop a landing page that effectively communicates the platform’s value while driving conversions.

Key Elements:

Hero Section:

A clean header with a compelling tagline: “Simplify Your Loans with Blockchain Transparency.”

A call-to-action button: “Get Started Now.”

Feature Highlights:

“Crypto-Powered Loan Management”: Explained the blockchain-based tracking and approval process.

“Track Your Loan, Anytime, Anywhere”: Highlighted real-time updates and financial insights.

“Secure and Transparent Transactions”: Built trust by explaining blockchain security.

User Testimonials: Showcased positive feedback from early adopters to build credibility.

Interactive Demo: Embedded a short video demonstrating the app’s features in action.

Design Process:

Wireframes: Mapped out user flows, emphasizing simplicity and accessibility.

Prototypes: Developed high-fidelity prototypes for testing interactions and usability.

User Testing: Conducted iterative testing with diverse user groups, refining the design based on feedback.

Visual Elements:

Color Palette: Mirrored the branding with shades of violet and lilac for trust and growth.

Typography: Used a modern, legible typeface for clarity.

Motion Design: Added subtle animations to enhance user interactions without overwhelming the experience.

App Design

Objective:

Create an intuitive and secure app experience for managing loans.

Key Features:

Seamless Loan Management:

Users can apply for loans, track approval statuses, and manage repayments effortlessly.

The dashboard provides a consolidated view of outstanding loans, repayment schedules, and financial insights.

Blockchain-Powered Transparency:

Users can access a detailed transaction history secured on the blockchain.

Smart contracts ensure clarity and reliability for all loan agreements.

Financial Insights:

Integrated financial analytics to help users make informed decisions.

Visualized loan repayment progress with data visualization tools.

User-Centric Design:

Clean and intuitive interface designed with Figma.

Consistent visual hierarchy and accessible navigation tailored to both experienced and new users.

Outcomes

The Finantz Loans Platform stands as a pioneering example of how blockchain technology is actively reshaping fintech solutions. As a Product Designer and UX Strategist, I am leading the ongoing efforts to create a platform that empowers users to manage loans with trust, transparency, and ease. Applying a user-first design approach, I am crafting intuitive workflows and interfaces that simplify complex financial tasks, ensuring accessibility and usability for a diverse audience.

The platform is currently in technical development, and strategic branding and marketing efforts are underway. These efforts aim to position Finantz as a modern and innovative solution in the competitive fintech landscape.

Lessons learned

The Finantz Loans Platform is an ongoing initiative to redefine loan management through blockchain technology, blending trust, transparency, and user-centric design. As a Product Designer and UX Strategist, I have focused on creating a seamless experience for users navigating the complexities of loan applications, approvals, and repayments. Leveraging blockchain's inherent transparency and security, the platform ensures users can confidently manage their loans and financial agreements with ease.

This project has offered valuable lessons in the crypto industry’s product design landscape, particularly in addressing user trust and simplifying technically dense concepts. Designing for crypto-fintech products requires balancing innovation with clarity. Users often find blockchain intimidating; therefore, crafting a simple, intuitive interface was paramount. Financial visualizations, transaction histories, and repayment tracking were built with accessibility and transparency, ensuring users can easily comprehend and trust the platform.

Additionally, the design effort emphasized the importance of user education and seamless onboarding in the crypto space. Clear micro-interactions, contextual help, and actionable feedback loops were integral in fostering user confidence, essential when dealing with emerging technologies like blockchain.

This experience deepened my understanding of the need for adaptive design frameworks to accommodate regulatory changes, user diversity, and evolving blockchain innovations. The Finantz platform’s ongoing technical development and marketing initiatives reflect this adaptability, ensuring the final product meets user expectations and set a new standard for crypto-enabled fintech solutions.